-

-

Like what you see?

LetsTalkUrl

Let's Talk

Unemployment Insurance (UI) is a program established under the Social Security Act of 1935. Each state runs its own unemployment insurance program and reports to the U.S. Department of Labor (USDOL), which oversees the UI program at the federal level. Each state has rules for calculating the weekly benefit amount and the maximum benefits payable. Typically, the calculation results in benefits that are approximately half of an individual's earnings from previous employment, lasting up to 26 weeks.

Most states fund UI benefits primarily through employer taxes, while the federal government covers administrative costs. Although states must adhere to certain federal requirements, most eligibility guidelines for the program are determined by state laws and regulations1.

Every year, billions of dollars are spent to administer unemployment insurance (UI) programs that provide benefits to millions of unemployed individuals as they search for new work. Since the COVID-19 pandemic, state agencies managing UI programs have faced immense pressure to deliver benefits accurately and have encountered numerous challenges, including fraud prevention, technology infrastructure, workforce training, policy complexity and changes, customer service, and data management.

UI agencies across the states report several types of fraud. Some common types include eligibility fraud, identity fraud, failure to report income, and misrepresentation.

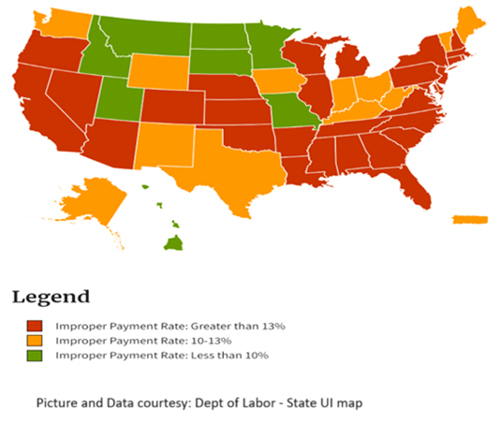

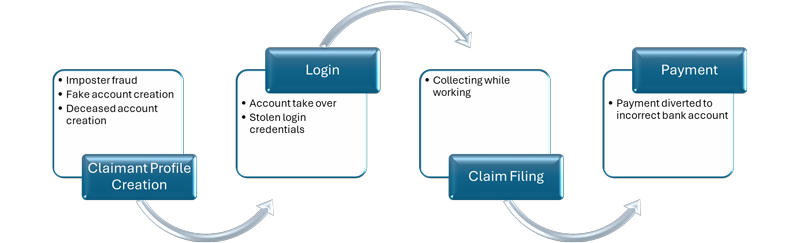

As shown in the picture above, there are various ways to commit fraud throughout the UI claim lifecycle. To combat this issue, state workforce agencies are implementing several identity verification and validation methods, starting from account creation and continuing through the entire lifecycle of UI claims. Despite these safeguards, the percentage of improper payments is still on the rise. Let's focus on identifying and mitigating the common types of fraud that occur in the UI system.

Eligibility fraud occurs when unqualified individuals intentionally provide incorrect information, such as failing to disclose a potentially disqualifying separation from employment or omitting earnings that may reduce or stop their benefit payments. During the claim filing and adjudication process, UI agencies use various data points and techniques to determine the legitimacy of the claimant and their claims.

Some widely used techniques employed by UI agencies include flagging claims, pattern matching through data analytics, and collaborating across agencies. These methods help identify fraudulent activities. However, UI agencies face several challenges due to the high volume of claims that need to be adjudicated, the asynchronous nature of data points, and the risk of incorrectly flagging claims as fraudulent, resulting in false positives. To address these issues, agencies can implement AI models to identify fraudulent claims and validate information using synchronous data points.

Although many AI-based fraud detection models are available in the market, most have been developed and trained for e-commerce fraud detection. In contrast, UI fraud detection requires a different set of parameters for effective training. Selecting the right algorithm and incorporating appropriate parameters are crucial for ensuring that the model can identify both new patterns of fraud and more established ones.

The primary objective of using AI-based fraud identification is to minimize false negatives and false positives, both of which create barriers and delays for legitimate users in need of program benefits. By employing strategies such as threshold tuning, temporal pattern analysis, geolocation tracking, behavioral biometrics, ensemble models, and feedback loops for learning, agencies can significantly reduce false positives.

An AI model can be trained to flag suspicious claims. For example:

The most crucial step in developing a successful AI model for fraud detection is to use high-quality training data, ensuring that at least 10% of the dataset includes fraudulent claims representing various types of fraud.

Additionally, implementing real-time monitoring of UI claims and assigning risk scores through AI models can significantly enhance the detection of fraudulent claims. By utilizing historical data, the AI model can automatically learn from evolving fraud techniques and help safeguard against fraud by flagging potentially fraudulent claims for review by state workforce agency staff. As actions are taken based on these reviews, the AI can be further trained to identify and reduce false positives.

However, some UI agencies have been hesitant to provide historical data. In such cases, manually creating synthetic data that covers different fraudulent scenarios can be an effective way to train the model.

Identity fraud occurs when criminals use someone else's information to fraudulently receive program benefits. This type of fraud can happen at any point during the UI claim lifecycle. Fraudsters often gain access to an individual's unemployment account or personal information through phishing emails and text messages. With this stolen personal information, they can file claims and divert benefit payments.

In many cases, a person who has had their identity stolen to file a fraudulent UI claim may not realize it until they attempt to file a claim for themselves, receive a 1099-G tax form, are referred to collections for an overpayment, or their employer informs them that a UI claim has been filed using their information.

UI agencies employ a variety of strategies to prevent identity fraud, utilizing traditional identity verification methods and data analytics. However, these strategies often fall short due to a surge in claims, the increasing sophistication of fraudulent actors, and a lack of resources and technological support.

To combat identity theft, state workforce agencies have implemented strict access controls that can be challenging for legitimate users to navigate. Striking a balance between effectively identifying fraudulent users and providing a user-friendly experience for legitimate claimants is a difficult task.

Maximizing identity fraud detection while improving the claim submission experience for legitimate users can be achieved through several strategies. These include an AI-based identity verification system that incorporates biometric authentication, image and facial recognition, multi-factor authentication, and re-authentication using security questions. Additionally, strategies such as bank account validation, behavior analysis, data validation using temporal patterns, anomaly detection through machine learning models, and NLP-based AI models to identify inconsistencies in language and uploaded documents can be beneficial. Implementing access controls like IP filtering to block suspicious IP addresses is also important.

Payments to eligible claimants are made regularly after the claims adjudication process, depending on user eligibility and state law and policy. However, bad actors can gain access to a legitimate claimant's account information and replace it with an account they control, allowing them to withdraw funds. Therefore, bank accounts should be validated during profile creation and whenever payment preferences are updated, as well as at the payment release stage. Utilizing third-party APIs such as Google Bank Verification, Plaid, LexisNexis, or the EWS API for account validation can be a wise option, as financial institutions own this data and possess additional information related to financial fraud.

Common frauds that occur in UI claims include failing to report income and misrepresentation fraud. Although state agencies employ multiple techniques to validate and adjudicate claims, these issues persist due to asynchronous data point validation and a lack of awareness among claimants. To reduce these frauds, UI agencies can implement a holistic verification process, which includes cross-checking with other agencies and validating data from national and state new hire systems and employer wage files. Additional efforts in data analytics, education, awareness, prompt investigation, and recovery are also essential.

State agencies can address challenges by modernizing their current technology infrastructure to incorporate AI-based solutions. This upgrade will enable the efficient adjudication of a large volume of claims and improve customer experience by offering self-service options. Additionally, it will help balance the identification of false positives and false negatives.

In addition to modernization, state agencies should collaborate with other agencies and law enforcement to proactively combat unemployment insurance fraud, rather than reacting only after incidents occur.

Providing periodic training for staff on technology tools, as well as changes in policies and complexities, will enhance their skills to manage complex unemployment insurance claims more efficiently and accurately.

State agencies can also launch public awareness campaigns to educate claimants about best practices and clear policy communication. This education can significantly reduce staff workloads.

Engaging in continuous monitoring, evaluation, and a feedback process will help state agencies identify areas for improvement and implement corrective actions effectively.

Additionally, collaborating with industry experts and partners can yield significant benefits, including data insights, advanced tools and technologies, real-time monitoring, best practices, cost-effectiveness, and enhanced threat management. By working together, unemployment insurance programs can achieve their goals and effectively serve millions of legitimate users.

Unemployment Insurance serves as a crucial safety net for many workers who are involuntarily unemployed, providing them with some income during difficult times. It also plays a vital role in stabilizing the U.S. economy by maintaining purchasing power during economic downturns or recessions. However, this safety net loses billions of dollars yearly due to fraudulent activities. To minimize the impact of fraud while ensuring timely payments to eligible individuals, Unemployment Insurance agencies can implement various strategies. These include using AI-based fraud detection, validating synchronous data points, verifying bank accounts, partnering with different agencies, and collaborating with industry partners.

Vaithiyanathan Thanikachalam is a senior project manager at Infosys Public Services. With 17 years of experience at Infosys, he has a strong background in functional and project management within public sector domains, such as the Department of Motor Vehicles (DMV), child welfare, and social programs. He has played a key role in designing innovative, customer-centric solutions.